SEBI Introduces New Rules for Delisting Offers

INTRODUCTION

On 10 June 2021, SEBI introduced the SEBI (Delisting of Equity Shares) Regulations, 2021 (Delisting Regulations) which have now completely replaced the erstwhile regulations from 2009. A revamp of the delisting regime was imminent, and SEBI has sought to plug certain legal ambiguities and practical challenges that plagued the earlier regulations. This Ergo analyses certain key considerations and process involved in a voluntary delisting of equity shares of a company under the new Delisting Regulations.

The Delisting Regulations do not apply to delisting pursuant to a resolution plan approved under section 31 of the Insolvency and Bankruptcy Code, 2016 subject to satisfaction of certain conditions. The Delisting Regulations have also introduced provisions relating to delisting of equity shares of a listed subsidiary company of a listed holding company pursuant to a scheme of arrangement under the Companies Act, 2013. These have been separately discussed in an earlier Ergo published on 15 June 2021.

KEY CONSIDERATIONS

Eligibility for delisting

To initiate delisting of a company, the acquirer proposing the delisting and the company itself are required to satisfy certain eligibility criteria:

|

|

Company should have been listed for at least 3 years; |

|

|

A cooling off period of at least six months should have elapsed from the date of completion of an earlier buyback, preferential allotment, or failed delisting offer; |

|

|

There should be no outstanding securities that are convertible into equity shares sought to be delisted; |

|

|

Acquirer should not have sold equity shares of the company at least six months prior to making the initial public announcement for the delisting offer; |

Except for the newly introduced ‘cooling off’ period, all the other eligibility criteria have been substantially retained from the erstwhile regulations.

Floor price and indicative price

The minimum acquisition price for the delisting is determined based on parameters set out in the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Regulations) and disclosed as the ‘floor price’. This concept has been carried over from the erstwhile regulations without any change.

Now the acquirer also has the option to disclose an ‘indicative price’ (higher than the floor price). As a matter of practice, an indicative price has been disclosed in several delisting offers over the years (to indicate to the market an acceptable price range) – the Delisting Regulations now formally recognise this concept. The acquirer also has the option to increase such indicative price until the bidding process commences.

Reverse book building process (RBB) and determination of discovered price

While the floor price/ indicative price (if specified) is fixed by the acquirer, RBB is implemented to determine the minimum price at which the shareholders are willing to accept the delisting offer. During RBB, the shareholders are free to tender their shares at any price over the floor price (Bids).

Based on the number of shares tendered and their corresponding price as per the Bids, a ‘discovered price’ is arrived at. Discovered price is the price at which shares accepted through eligible Bids takes the shareholding of the acquirer (along with persons acting in concert) to at least 90% of the company’s share capital (excluding shares underlying depository receipts, and shares held by ESOP trusts, inactive shareholders such as vanishing companies, struck off companies, etc) (90% Threshold). If the 90% Threshold is not met, the delisting offer fails.

Success of the delisting offer

If the 90% Threshold is achieved, the following scenarios may arise:

|

|

Discovered price equal to the floor price: The acquirer will be bound to acquire all shares that are validly tendered at the floor price, and the delisting will be successful. |

|

|

|

Discovered price higher than the floor price but equal to or less than the indicative price (if specified): The acquirer will be bound to acquire at the indicative price, all shares that are validly tendered at or below the indicative price, and the delisting will be successful. |

|

|

|

Discovered price higher than the floor price/ indicative price (if specified): The acquirer will have the option to accept or reject the discovered price. |

|

|

|

|

If accepted, the acquirer will be bound to acquire at the discovered price, all shares that are validly tendered at or below the discovered price, and the delisting will be successful. |

|

|

|

If rejected, the shares tendered will have to be returned and the delisting fails. |

|

|

Counter-offer: If the discovered price is not acceptable, the acquirer may make a counter offer by specifying a counter offer price. Such price may be lower than the discovered price but cannot be lower than the book value of the company (computed based on the standalone and consolidated financials of the company as per the Delisting Regulation and certified by the manager to the delisting offer). If the 90% Threshold is achieved on making a counter-offer, then the delisting will be successful. |

|

|

|

Option to offer more than the discovered price: The acquirer also has the option to offer a price higher than the discovered price. This would enable the acquisition of additional shares tendered in the RBB above the discovered price. |

|

Financial arrangements for a delisting offer

Prior to commencing the delisting offer process, the acquirer is required to ensure that it has firm financial arrangements in place to fulfil its payment obligations. The funds of the company cannot be employed, either directly or indirectly, for this purpose.

The acquirer is also required to set up an escrow account and deposit the total consideration amount (calculated based on the floor price or the indicative price (if specified)) in a phased manner. The amount may be deposited either in cash and/ or in the form of a bank guarantee.

Exit period for residual shareholders

Post a successful delisting, for a period of one year (exit period), the acquirer is obliged to acquire shares voluntarily tendered by residual shareholders (i.e. those who continue to hold shares post a successful delisting offer) at the final delisting price. The consideration for such acquisition is also required to be placed in escrow for the duration of the exit period.

OVERVIEW OF THE DELISTING OFFER PROCESS

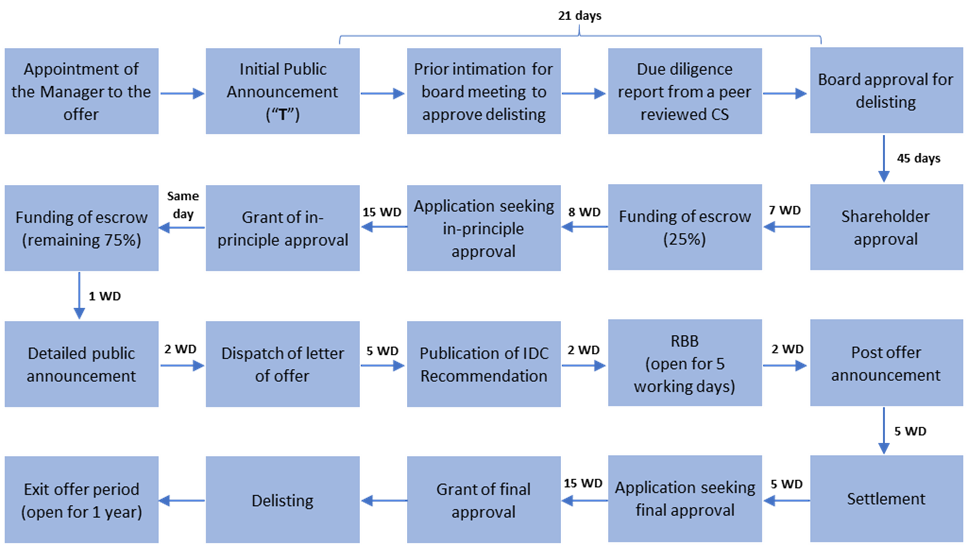

A brief chronological path for the delisting process is set out below:

The delisting process commences with the filing of an initial public announcement (IPA) to the stock exchanges. It must also be sent to the company within 1 working day.

The company’s board is required to consider and approve the delisting proposal within 21 days from the date of the IPA, inter alia considering the due-diligence report on specified transfers of company’s shares, procured from a peer reviewed company secretary. The prior intimation for holding the said board meeting would be the reference date for determining the floor price. The outcome of the board meeting along with the due-diligence report is required to be disclosed within 30 mins from its conclusion.

Within 45 days from the board meeting, shareholders’ approval is to be sought by a special resolution through postal ballot and/ or e-voting. The special resolution can be acted upon only if the votes cast by the public shareholders in favour of the proposal are at least 2 times the number of votes cast by the public shareholders against it.

The company is required to make an application to the stock exchanges seeking an in-principle approval within 15 working days from the date of shareholders’ approval or receipt of all requisite statutory/ regulatory approvals, if any, whichever is later. The stock exchanges are required to dispose of the application within 15 working days from the receipt of application that is complete in all respects.

A detailed public announcement (DPA) is required to be published within 1 working day from receipt of the in-principle approval. The letter of offer (LOF) is required to be dispatched to the shareholders within 2 working days from the DPA.

The recommendation of the committee of independent directors of the company must be published at least 2 working days before commencement of RBB.

RBB must commence within 7 working days of dispatch of the LOF and must remain open for 5 working days. The outcome of RBB should be announced within 2 hours from its closure.

A post offer announcement (POA) is to be made within 2 working days from closure of RBB, disclosing the success / failure / intent to make a counter offer.

In case the delisting offer succeeds, payment of consideration for shares that are accepted must be completed in accordance with the Delisting Regulations. Where the final delisting price is equal to the floor price/ indicative price, the payment is made through the secondary market settlement mechanism. However, if the final delisting price is in excess of the floor price/ indicative price, the acquirer is granted additional time of 5 working days from the POA to complete the payment.

Within 5 working days from payment to the shareholders, the acquirer is required to make an application seeking final approval of the stock exchanges. The stock exchanges are required to dispose of the application within 15 working days from the receipt of application that is complete in all respects. Upon grant of final approval, the shares of the company will be delisted.

COMMENT

The Delisting Regulations attempt to introduce a more streamlined and timebound process, while addressing various lacunae in the erstwhile regulations such as clarity on delisting timelines, delisting success thresholds and computation of book value in a counter-offer situation. Further, elements from the well-established processes under the Takeover Regulations such as recommendation of independent directors have been introduced to augment investor protection. To sum up, although certain stipulations may need to be ironed out, the new delisting regime is certainly an improvement on its predecessor – it will be interesting to observe if the new regime helps improve the success rate of delisting offers in India.

- Arindam Ghosh (Partner), Abhishek Dadoo (Partner), Gaurav Malhotra (Principal Associate), Shashank Patil (Principal Associate) and Anvita Mishra (Senior Associate)

For any queries please contact: editors@khaitanco.com

We have updated our Privacy Policy, which provides details of how we process your personal data and apply security measures. We will continue to communicate with you based on the information available with us. You may choose to unsubscribe from our communications at any time by clicking here.

For private circulation only

The contents of this email are for informational purposes only and for the reader’s personal non-commercial use. The views expressed are not the professional views of Khaitan & Co and do not constitute legal advice. The contents are intended, but not guaranteed, to be correct, complete, or up to date. Khaitan & Co disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident or any other cause.

© 2024 Khaitan & Co. All rights reserved.

Mumbai

One World Centre

10th, 13th & 14th Floor, Tower 1C

841 Senapati Bapat Marg

Mumbai 400 013, India

Mumbai

One Forbes

3rd & 4th Floors, No. 1

Dr. V. B. Gandhi Marg

Fort, Mumbai 400 001

Delhi NCR (New Delhi)

Ashoka Estate

11th Floor, 1105 & 1106,

24 Barakhamba Road,

New Delhi 110 001, India

Kolkata

Emerald House

1B Old Post Office Street

Kolkata 700 001, India

Bengaluru

Embassy Quest

3rd Floor

45/1 Magrath Road

Bengaluru 560 025, India

Delhi NCR (Noida)

Max Towers,

7th & 8th Floors,

Sector 16B, Noida

Uttar Pradesh 201 301, India

Chennai

8th Floor,

Briley One No.30

Ethiraj Salai

Egmore

Chennai 600 008, India

Singapore

Singapore Land Tower

50 Raffles Place, #34-02A

Singapore 048623

Pune

Raheja Woods

03-108-111, 3 Floor

8, Central Avenue, Kalyani Nagar

Pune - 411 006, India

Gurugram (Satellite Office)

Suite No. 660

Level 6, Wing B,

Two Horizon Center

Golf Course Road, DLF 5

Sector 43, Gurugram

Haryana 122 002, India

Ahmedabad

1506 - 1508, B-Blockr

Navratna Corporate Parkr

Iscon Ambli Road, Ahmedabadr

Gujarat - 380058