Partner | Investment Funds, Private Equity, Corporate and Commercial

- T: +91 22 6636 5000

- E: Write to me

education

- MBA (Finance), New Hampshire College, Boston (1996)

- LL.B., Saurashtra University

- Bachelor of Engineering (Mech), Saurashtra University (1993)

Siddharth Shah is a senior partner with Khaitan & Co in its Mumbai office and leads the funds practice for the firm. He has over 20 years of professional experience in advising clients in the matters relating to fund formations, setting up of investment platforms, structuring of private equity investments and other corporate transactional matters dealing with joint ventures and M&As in public and private space.

He has vast experience on the funds side having acted as fund counsel to a wide range of domestic and offshore funds across assets classes ranging from angel, venture capital, private equity, real estate, credit, distress asset, public market and hedge funds, REITs, INVITs etc. He advises them on the legal, regulatory and tax matters.

Because of his vast experience in the fund sector in India, he is regularly invited by the industry associations like IVCA, CII, IMC, APREA, etc. and policy makers such as SEBI and RBI to be part of various regulatory committees and contribute to new policy initiatives. He has been an active contributor in the formulation of the current SEBI guidelines for setting up of AIFs in International Finance Centre like GIFT.

Siddharth is also a regular contributor to leading business dailies and journals, and also frequently invited for his views by leading business television channels as a subject matter expert in his areas of practice. He is also a regular speaker at various conferences and public forums, both in India and overseas.

Professional Affiliations

- Bar Council of Maharashtra and Goa

Recognition and Accomplishments

India Business Law Journal (IBLJ) has recognised Siddharth in "the A list" of India's Top Lawyers for 2019.

Who’sWho Legal: Private Funds” lists Siddharth Shah as the leading lawyer in the Private Fund Formation space in India.

Chambers and Partners (Asia – Pacific) has ranked Siddharth Shah as a top-ranking lawyer since 2009.

IFLR 1000 has ranked Siddharth as "Highly Regarded" lawyer in its lawyer rankings.

AsiaLaw Leading Lawyers Guide 2020 has recognised Siddharth as an "Elite Practioner" in Private Equity space.

The Legal 500, (Asia Pacific) has mentioned Siddharth as a leading individual in the Investment Funds practice.

Representative Matters

Siddharth Shah has represented and advised the following clients

Meritz Financial Group

Represented Meritz Financial Group, Korea on their investment platform with Edelweiss Group with targeted corpus of USD 425 million focussed on providing last mile financing for real estate projects.

Nederlandse Financierings Maatschappij

Represented Nederlandse Financierings Maatschappij voor Ontwikkelingslanden N.V. ("FMO"), on their investment of USD 42 million into Aavishkar Group, one of the leading investor in the impact investing space.

IDFC Alternatives Limited

Represented IDFC Alternatives Limited in its sale of infrastructure asset management business as well as real estate/private equity asset management business to Global Infrastructure Partners and Investcorp respectively.

Piramal

Represented Piramal in their partnership with Bain Credit for setting up of a distress asset platform Indian Resurgence Fund and acting as the fund counsel for the fund with a targeted corpus USD 750 million.

Allianz Group

Represented Allianz Group in their partnership with Shapoorji Pallonji Group to set up a USD 500 million real estate platform which proposed to invest in commercial office properties in India.

Gujarat International Finance Tech

Advised Gujarat International Finance Tech (GIFT) city on formulation of guidelines for setting up of FPIs and Alternative Investment Funds (AIFs) by SEBI.

Phoenix Marketcity Limited

Represented Phoenix Marketcity Limited for its platform with Canada Pension Plan Investment Board (CPPIB) to invest in retail and commercial assets across India with a target size of approx. USD 250 million.

ICG Strategic Equity Advisors

Acted as Indian counsel to ICG Strategic Equity Advisors for their acquisition of Indian private equity portfolio investments held by Standard Chartered Private Equity and its affiliates as part of the global take over.

Milestone Capital Advisors Limited

Represented Milestone Capital Advisors Limited for their sale of the private equity asset management business to Edelweiss.

Publications

Ergo Update

Ergo Update

Ergo Update

Ergo Newsflash

Ergo Update

News and Events

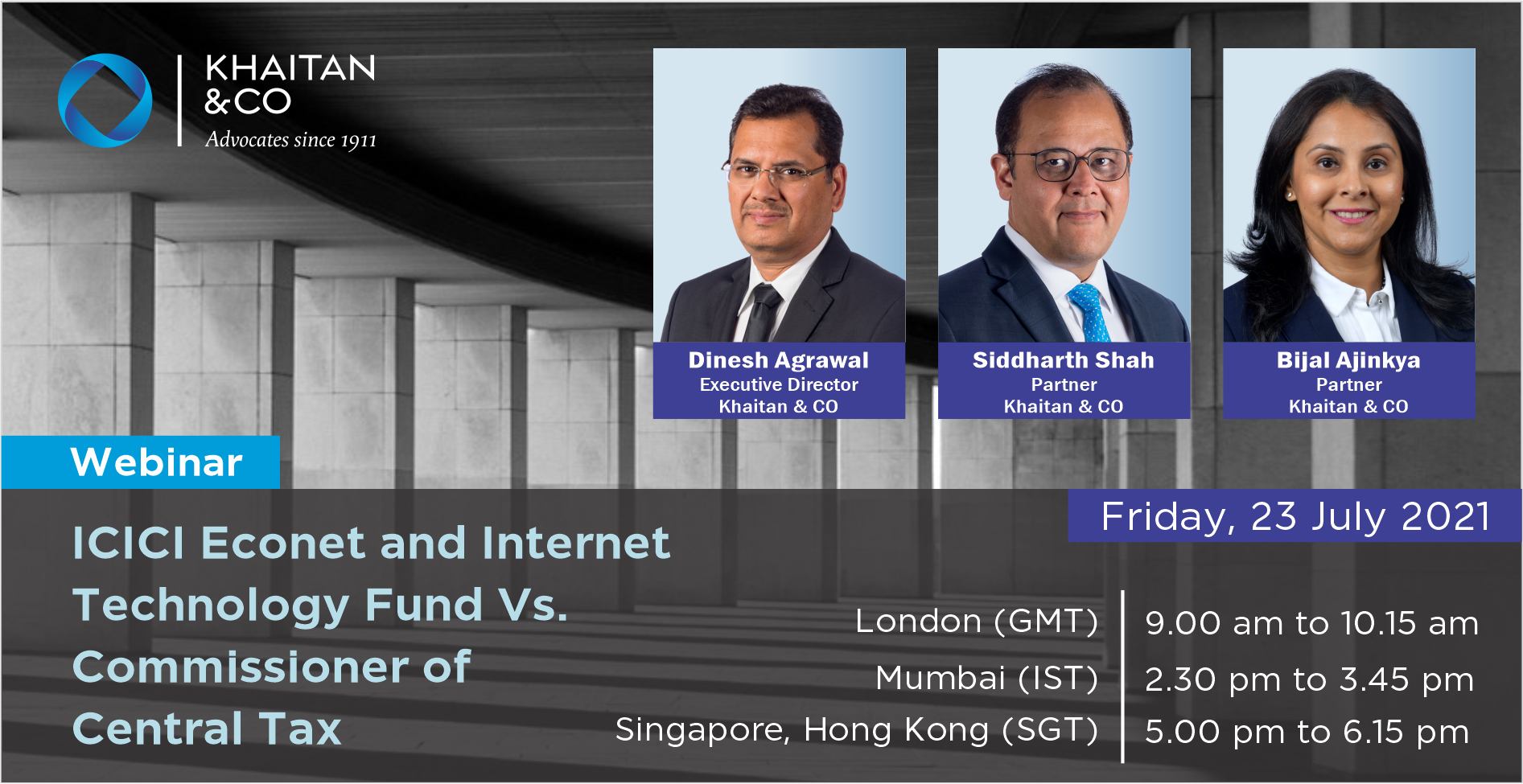

Siddharth Shah has featured in the following news and webinars