Government constitutes GAAR Panel under the Income-tax Law

Introduction

In a significant development, the Government of India vide its communication dated 11 February 2022 has informed the senior level tax officers that a secretariat has been set up in New Delhi for providing assistance to the approving panel under the General Anti-Avoidance Rule (GAAR) provisions of the Income-tax Act, 1961 (IT Act). The communication also mentions that the approving panel under the GAAR provisions has been constituted vide office order no 37/2022 dated 24 January 2022 (Approving Panel).

Background

In the past few years, Indian Income-tax law has gone through a paradigm shift wherein several measures have been introduced under the IT Act to combat tax avoidance and move towards ‘substance’ based taxation. One such measure was introduction of GAAR under the domestic legislation with effect from 01 April 2017. GAAR codifies the doctrine of ‘substance over form’ where the intention of the parties, real effect of the transactions and the purpose of an arrangement are taken into account for determining whether the same deviate from the ‘form’ thereof, and the tax consequences are determined accordingly.

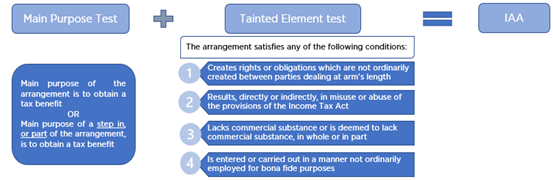

GAAR provisions give wide powers to tax authorities to treat any arrangement or a transaction as an ‘impermissible avoidance arrangement’ (IAA) and re-compute income and consequent tax implications thereon. An arrangement or a transaction is considered as an IAA if it meets the ‘main purpose test’ and ‘tainted element test’

In such cases, the tax authorities are empowered to determine tax implications based on ‘substance’ ignoring the ‘form’ of the arrangement. Some of the illustrative powers are:

|

Ø |

Disregarding or combining or re-characterising any step in, or a part or whole of the arrangement |

|

Ø |

Treating the arrangement as if it had not been entered into or carried out |

|

Ø |

Relocating the place of residence of a party, or situs of an asset or of a transaction to a place other than provided in the arrangement |

|

Ø |

Looking through the arrangement by disregarding any corporate structure |

|

Ø |

Re-characterising equity into debt, capital into revenue, etc. |

|

Ø |

Denying benefits of a Treaty |

Having said the above, there are certain exceptions where GAAR provisions are not applicable such as where (i) the amount of tax benefits arising to the parties to an arrangement or a transaction in aggregate in the relevant year does not exceed INR 30 million or (ii) the income is earned from transfer of investments which were made before 1 April 2017.

Further, inbuilt safeguards / checks and balances have also been inserted in the GAAR provisions to ensure their fair application by the tax authorities. A time bound procedure has been prescribed which starts with the tax officer proposing to the prescribed senior officer if he considers that the arrangement or a transaction is an IAA. Such proposal to declare an arrangement as an IAA is vetted first by the prescribed senior officer and then by an Approving Panel, headed by a serving or retired Judge of a High Court. During such proceedings, the taxpayer may be called upon to furnish such information/explanation as may be required, before issuing any directions. Thus, invocation of GAAR provisions primarily depend upon the directions issued by the Approving Panel. The composition of Approving Panel is as under:

|

Criteria |

Designation |

|

Serving or retired Judge of a High Court |

Chairman |

|

Member of Indian Revenue Service, not below the rank of Principal Chief Commissioner or Chief Commissioner of Income-tax |

Member |

|

An academic or scholar having special knowledge of matters such as direct taxes, business accounts and international trade practices |

Member |

Comments

GAAR is a highly sophisticated anti-evasion statutory tool in the hands of tax authorities. Given the wide scope of GAAR provisions and consequences of a transaction being declared as an IAA, it is imperative to evaluate existing as well as proposed arrangements and structures on the touchstone of ‘main purpose test’ and ‘tainted element test’ as mentioned above.

When the GAAR provisions were introduced, it was an apprehension among stakeholders as to whether the provisions would be properly implemented or not. To ensure that these provisions are invoked in genuine cases, the Government introduced the concept of high-level Approving Panel along with a time bound procedure. Now, with the Approving Panel in place, these provisions – which came into effect from 01 April 2017 – have finally become operational. In the scheme of GAAR provisions, the Approving Panel holds an important role because the invocation or non-invocation of GAAR in a particular transaction depends to a great extent on the vetting of an arrangement by the Approving Panel. Therefore, this a significant development in the context of Indian Income-tax law. Since the Approving Panel is headed by a High Court judge and supplemented by other distinguished members, there is an inbuilt assurance that a balanced approach will be adopted in adjudicating whether a case really merits invocation of GAAR or not.

The applicability of these provisions is very wide as it is intended to cover not only cross border transactions but domestic transactions also. Given that the purpose with which the concept of Approving Panel was introduced in the Indian Income-tax law, one hopes that the GAAR provisions are invoked in genuine cases only.

- Sanjay Sanghvi (Partner), Raghav Kumar Bajaj (Principal Associate), Ujjval Gangwal (Senior Associate)

For any queries please contact: editors@khaitanco.com

We have updated our Privacy Policy, which provides details of how we process your personal data and apply security measures. We will continue to communicate with you based on the information available with us. You may choose to unsubscribe from our communications at any time by clicking here.

For private circulation only

The contents of this email are for informational purposes only and for the reader’s personal non-commercial use. The views expressed are not the professional views of Khaitan & Co and do not constitute legal advice. The contents are intended, but not guaranteed, to be correct, complete, or up to date. Khaitan & Co disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident or any other cause.

© 2024 Khaitan & Co. All rights reserved.

Mumbai

One World Centre

10th, 13th & 14th Floor, Tower 1C

841 Senapati Bapat Marg

Mumbai 400 013, India

Mumbai

One Forbes

3rd & 4th Floors, No. 1

Dr. V. B. Gandhi Marg

Fort, Mumbai 400 001

Delhi NCR (New Delhi)

Ashoka Estate

11th Floor, 1105 & 1106,

24 Barakhamba Road,

New Delhi 110 001, India

Kolkata

Emerald House

1B Old Post Office Street

Kolkata 700 001, India

Bengaluru

Embassy Quest

3rd Floor

45/1 Magrath Road

Bengaluru 560 025, India

Delhi NCR (Noida)

Max Towers,

7th & 8th Floors,

Sector 16B, Noida

Uttar Pradesh 201 301, India

Chennai

8th Floor,

Briley One No.30

Ethiraj Salai

Egmore

Chennai 600 008, India

Singapore

Singapore Land Tower

50 Raffles Place, #34-02A

Singapore 048623

Pune

Raheja Woods

03-108-111, 3 Floor

8, Central Avenue, Kalyani Nagar

Pune - 411 006, India

Gurugram (Satellite Office)

Suite No. 660

Level 6, Wing B,

Two Horizon Center

Golf Course Road, DLF 5

Sector 43, Gurugram

Haryana 122 002, India

Ahmedabad

1506 - 1508, B-Blockr

Navratna Corporate Parkr

Iscon Ambli Road, Ahmedabadr

Gujarat - 380058