Future-proofing your business: Analysing the MCA’s Recommendations on Business Responsibility Reporting

Global trends towards a stakeholder-centric governance model have resulted in a structured movement towards responsible business conduct. Companies are expected to be driven not only by profitability but also the increasingly relevant non-financial parameters measured through impact on society and the environment, popularly referred to as the ‘triple bottom line’.

ESG (environment, social and governance) related risks are being factored in by “socially-conscious” investors. Large institutional investors that had previously taken passive stances on ESG-related issues have become more assertive. Reports suggest that ESG-mandated assets could grow almost three times as fast as non-ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025.[1] The business case for ESG-based performance includes better risk management which in turn creates long term value by providing access to capital, operational benefits and goodwill.

Business Responsibility Reporting in India

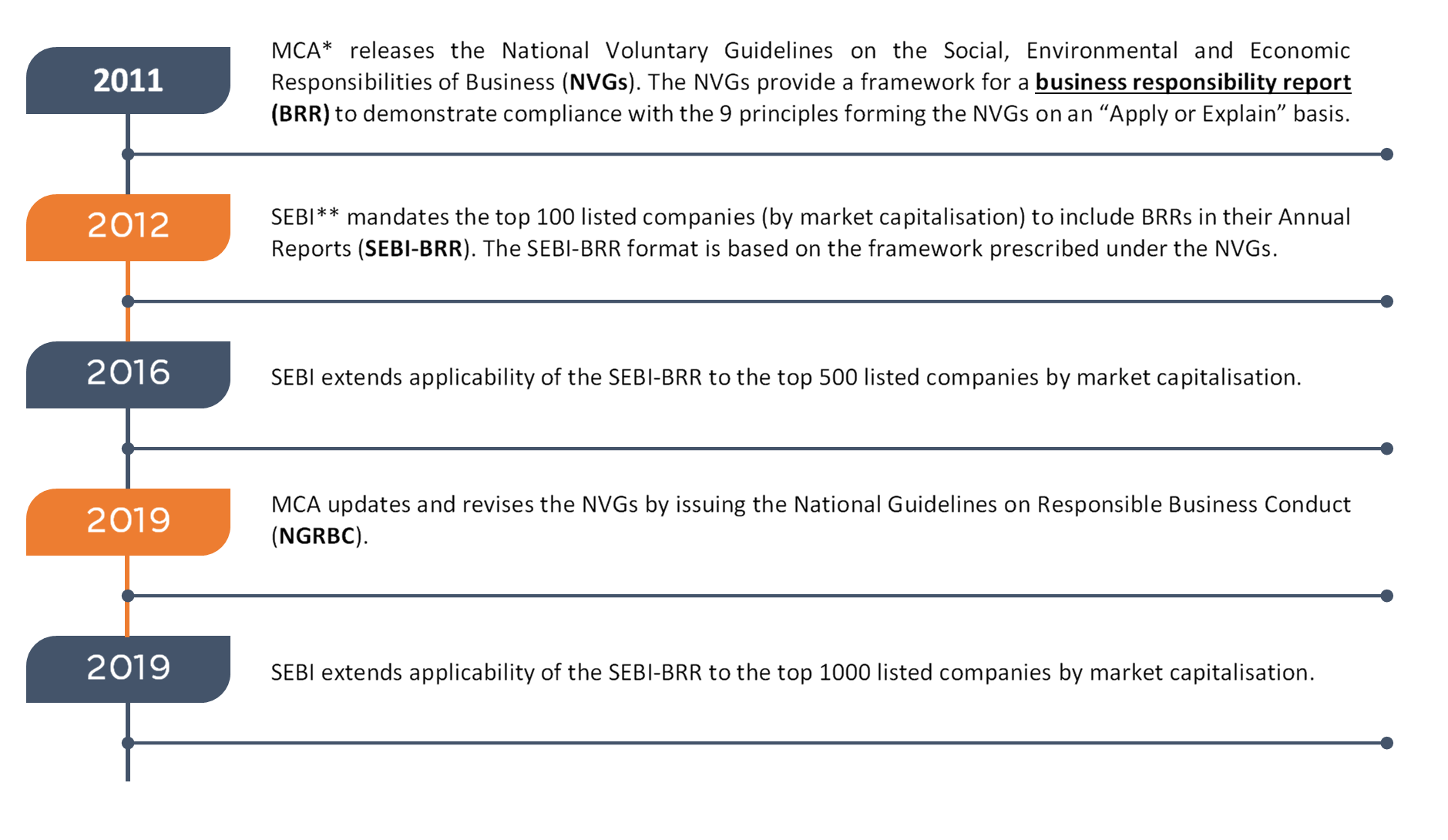

Market demand and regulatory developments have been the two key drivers for development of ESG-based performance metrics in India. Over the past decade, India has developed its very own business responsibility reporting framework enabling disclosures on key non-financial parameters in line with global commitments and legislative advancements.[2] The timeline below sets out the implementation of this reporting framework:

|

*Ministry of Corporate Affairs **Securities and Exchange Board of India |

MCA Committee Recommendations for an enhanced BRR framework

Simultaneous to the adoption of the more refined NGRBC vis-à-vis NVGs, the MCA constituted a Committee on Business Responsibility Reporting (Committee) in 2018 to review the existing BRR framework and to formulate a tech-integrated, user-friendly, single and comprehensive reporting framework to measure non-financial parameters. Basis this review, the Committee published its report on 11 August 2020 (Report) with a recommendation that the revamped formats be formally adopted by regulators in a phased manner beginning 2021-22.

Key changes recommended by the Committee are as follows:

|

Ø |

Thrust on ‘Sustainability’: The Report recommends that the format should undergo a name change and be referred to as the ‘Business Responsibility and Sustainability Report (BRSR). The revised name highlights the importance of integrating sustainability principles in traditional business practices and embracing it as a measure of good governance. |

|

Ø |

BRSR Lite: In order to nudge unlisted companies, SMEs and new entrants towards voluntary disclosures, the Report provides a pared down Lite version of the regular BRSR format. While the Lite version continues to be mapped against the principles and the core elements prescribed in the NGRBC, it is a simpler and shorter format keeping in mind costs and burden of compliance for such companies. |

|

Ø |

Guidance Notes to Aid Disclosures: Given the extensive stakeholder discussions preceding the Report, the Committee has been mindful of the challenges faced by companies in their SEBI-BRR disclosures. To promote quality disclosures, the Report provides detailed guidance notes on the BRSR and the BRSR Lite. This typically serves the purpose of an instruction kit as is provided for forms that are to be filed with the Registrar of Companies. |

|

Ø |

E-filing and MCA21 Integration: Lack of digital integration has been a big drawback of the BRR framework. To rectify matters, the Report proposes that the BRSR formats be filed electronically and be integrated with filings made by companies on the MCA21 portal. The BRSRs would therefore, have pre-populated information based on filings already made, drop down menus, where applicable and overall, easier navigation options. |

|

Ø |

Addressing Inadequate Disclosures: The Report states that an analysis of the disclosures made by companies in the SEBI-BRRs highlights the disparity in the quality of disclosures between companies. It seeks to remedy this to some extent by providing a mix of quantitative and qualitative data-based questions in the BRSRs. Where required, questions have been made more detailed or simplified/ pointed to enable clear and accurate disclosures. Questions around value chain, labour welfare and participation by women and the differently abled have received added emphasis in the BRSRs. |

|

Ø |

Enhanced Coverage: The Report proposes that the BRSRs be extended to certain other companies and businesses (for example: unlisted companies, LLPs etc) which meet specified thresholds of turnover and/ or paid-up capital in a staggered manner. |

Conclusion

The goal of the NGRBC and the BRSR framework is a lofty one that needs concerted government and industry participation for its success. In a business environment affected by COVID, ESG considerations would continue to be at the forefront with Boards likely to focus on long-term value creation. In this context, the MCA’s recommendations on the BRSR framework is timely and will allow for standardisation of ESG-factors as well as bring greater quality and accuracy to such non-financial reporting.

While the BRSR Lite is a welcome step towards wider implementation, the preparedness of each company to adapt and align itself (sometimes, at quick notice) and ability to take on the added compliance will need to be kept in mind by SEBI and other regulators before formally adopting the recommendations in the Report.

The Report also states that a Business Responsibility-Sustainability Index is in the pipeline. If implemented well, this index could set the stage for greater ESG-based investments in India.

As first step towards implementation, SEBI has, on 18 August 2020, released a consultation paper seeking stakeholder comments on the adoption of the BRSR format proposed by the Committee. Also, with the MCA steering the process of formulating a National Action Plan on Business and Human Rights (NAP), it is evident that themes around being socially responsible coupled with an enhanced focus on corporate governance are here to stay. Demonstrating leadership in ESG may well become a differentiating factor for companies and Boards will have to stay ahead of the game and re-design strategy to push this agenda forward.

- Suhana Islam Murshedd (Partner) and Riya Dutta (Senior Associate)

For any queries please contact: editors@khaitanco.com

[1] Deloitte Insights, “Advancing environmental, social, and governance investing” 20 February 2020 (click here)

[2] For example, India’s ratification of the Paris Agreement for Climate Change 2015, the United Nations 2030 Agenda for Sustainable Development (SDGs), CSR provisions under the Companies Act 2013, etc.

We have updated our Privacy Policy, which provides details of how we process your personal data and apply security measures. We will continue to communicate with you based on the information available with us. You may choose to unsubscribe from our communications at any time by clicking here.

For private circulation only

The contents of this email are for informational purposes only and for the reader’s personal non-commercial use. The views expressed are not the professional views of Khaitan & Co and do not constitute legal advice. The contents are intended, but not guaranteed, to be correct, complete, or up to date. Khaitan & Co disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident or any other cause.

© 2024 Khaitan & Co. All rights reserved.

Mumbai

One World Centre

10th, 13th & 14th Floor, Tower 1C

841 Senapati Bapat Marg

Mumbai 400 013, India

Mumbai

One Forbes

3rd & 4th Floors, No. 1

Dr. V. B. Gandhi Marg

Fort, Mumbai 400 001

Delhi NCR (New Delhi)

Ashoka Estate

11th Floor, 1105 & 1106,

24 Barakhamba Road,

New Delhi 110 001, India

Kolkata

Emerald House

1B Old Post Office Street

Kolkata 700 001, India

Bengaluru

Embassy Quest

3rd Floor

45/1 Magrath Road

Bengaluru 560 025, India

Delhi NCR (Noida)

Max Towers,

7th & 8th Floors,

Sector 16B, Noida

Uttar Pradesh 201 301, India

Chennai

8th Floor,

Briley One No.30

Ethiraj Salai

Egmore

Chennai 600 008, India

Singapore

Singapore Land Tower

50 Raffles Place, #34-02A

Singapore 048623

Pune

Raheja Woods

03-108-111, 3 Floor

8, Central Avenue, Kalyani Nagar

Pune - 411 006, India

Gurugram (Satellite Office)

Suite No. 660

Level 6, Wing B,

Two Horizon Center

Golf Course Road, DLF 5

Sector 43, Gurugram

Haryana 122 002, India

Ahmedabad

1506 - 1508, B-Blockr

Navratna Corporate Parkr

Iscon Ambli Road, Ahmedabadr

Gujarat - 380058