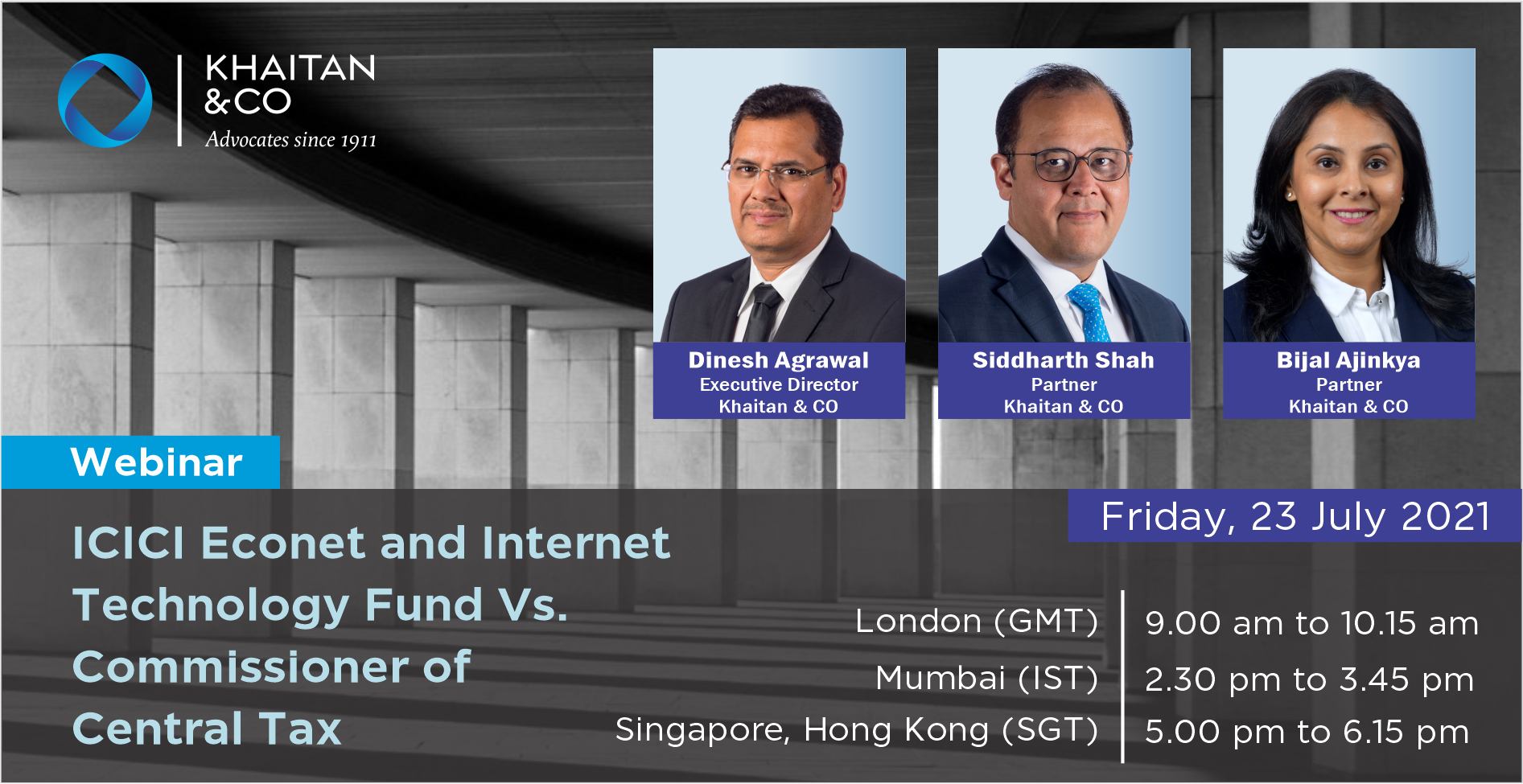

Dinesh Agrawal

Executive Director | Indirect Tax

- T: +91 22 6636 5000

- E: Write to me

education

- C.A., Institute of Chartered Accountants of India (1988)

- Cost and Works Accountant, Institute of Cost & Works Accountants of India (1988)

- B.Com. (Hons.). Kolkata University (1987)

Dinesh Agrawal joined the Firm in the year 2006 and co-heads the Indirect Tax practice in Mumbai. Prior to joining the Firm, he served with the Customs and Central Excise department of the Government of India for sixteen years.

He specialises in customs valuation, classification, goods and services tax, foreign trade laws, export controls and trade remedies and has advised clients on special economic zones, free trade areas and legacy indirect taxes such as service tax, VAT and excise. Being a prior revenue officer, Dinesh has the expertise in assisting clients with ring-fencing and handling regulatory investigations and has also appeared in court multiple times and obtained favourable judgments.

Dinesh is also an active member of the Indirect tax committee of various trade bodies and is often invited as a speaker / panellist at a number of professional seminars organised by ASSOCHAM and ICAI and others.

Expertise

Professional Affiliations

- Fellow member of the Institute of Chartered Accountants of India

- Associate member of the Institute of Cost & Works Accountants of India

Representative Matters

Dinesh Agrawal has represented and advised the following clients

EIH Limited

Advised on GST transition.

Hardcastle Restaurants Private Limited

Represented and advised in the proceedings before the National Anti-Profiteering Authority and the High Court of Bombay.

A leading multi-national electronic commerce entity

Advised in relation to GST and related Indirect Tax Advisory including diligence for various transactions and investments.

Toyo Engineering

Advised on drafting and finalizing an EPC contract for setting up oil blending plant.

The Tata Power Company Limited

Advised in relation to service tax demand on electricity transmission and GST related advisory.

Pfizer Healthcare India Private Limited

Advised on labelling and packaging standards for drugs.

Ensono Technologies LLP

Advised in relation to obtaining approvals and hand-holding services under SEZ law.

Magotteaux Co Limited, Thailand

Represented and advised on drafting, appearing and providing hand-holding services before the Directorate General of Trade Remedies and the Appellate Tribunal in relation to a sunset review investigation on imports of Grinding Media Balls.

FAG Bearings India Limited

Represented and advised on drafting, analysis and appearance before the Directorate General of Trade Remedies in relation to anti-dumping investigation on imports of seamless pipes and tubes.

Publications

Ergo Update

Ergo Newsflash

Ergo Update

Ergo Newsflash

Ergo Update

News and Events

Dinesh Agrawal has featured in the following news and webinars