Partner | Direct Tax, Estate Planning, Trusts and Private Client, Investment Funds

- T: +91 22 6636 5000

- E: Write to me

education

- LL.M., (International Law), University of Mumbai (2002)

- LL.B., Government Law College, University of Mumbai (2000)

Bijal Ajinkya is a partner in the Direct Tax, Private Client and Investment Funds practice groups in the Mumbai office with over 23 years of experience. On the tax side, Bijal primarily focuses on international tax, structuring of inbound and outbound investments, tax structuring of flip, SPAC transactions, complex M&A tax negotiations, tax insurance, WNI insurance, providing opinions on complex tax issues on international tax, GAAR, POEM, PE, & MFN, etc.

On the tax litigation front, she has immense experience in providing advice on unique litigation strategies and has been a lead advisor in many successful and path breaking tax litigations in India. She has also served as an expert witness on Indian tax matters in an international arbitration. She has recently successfully concluded a tax information exchange case which is a first precedent case on the interpretation of tax information exchange provisions with a country in the Channel Islands.

She has also led many successful international tax litigations in India on the India-Mauritius Tax Treaty, Azadi Bachao Andolan, Applicability of Minimum Alternate Tax for Foreign Portfolio Investors for International Financial Associations, Taxation of Outsourcing in India for Morgan Stanley, Taxation of Online services for Dun & Bradstreet, Taxation of a Mauritius Protected Cell Company for Nicholas Applegate, to name a few.

As a Private Client practitioner, Bijal has varied experience in advising individuals and family businesses on succession planning, asset protection and cross border inheritance tax from a legal, regulatory and tax perspective. She has advised many family-owned organizations on creating frameworks for succession to wealth, leadership and management.

She has pioneered tax structures for investment funds and managers and had been nominated by IFA, India as the India country reporter in the global IFA congress to provide a report in the International Cahiers Edition, 2019 on the topic of ‘Investment Funds’. Over the years Bijal has developed a deep understanding of the Funds space and advises clients on fund formation involving advice related to fund structuring and carried interest structuring. She has been a counsel to fund managers and investment funds before the income tax authorities on their tax assessments. Bijal has also successfully represented several foreign institutional investors (FIIs) in relation to the issue of Minimum Alternate Tax (MAT) before the Bombay High Court.

Bijal regularly features on an annual basis in the Chambers & Partners (Asia – Pacific), Citiwealth Leaders List, Asia Law, Legal 500, International Tax Review (Asia Pacific), Who’s Who Legal “Corporate Tax Guide, Private Client Global Elite, Expert Guides – Tax 2018, Indian Lawyer 250 Law Business Research as a leader in the field of taxation, investments funds and private client in India. She has recently been ranked as a Leader Tax Champion in India by Legal Era, and has also been recognised by Asian Legal Business in their 2021 ranking as Asia’s Top 15 Female Lawyers. Bijal has featured on IBLJs future legal leaders list for India, 2021.

Bijal is the first Indian qualified lawyer to be admitted as an international fellow to the The American College of Trust and Estate Counsel (ACTEC). Bijal previously served as an officer-elect on the Individual Tax & Private Client Committee of the International Bar Association. She is an ex-officio member of the Steering Committee of the International Wealth Advisors Forum. She regularly contributes to the IVCA with respect to changes which should be made on the tax landscape for investment funds.

She is actively engaged in making representations and participating in consultations with the Indian Government on new tax policies and key legal issues.

Professional Affiliations

- Bar Council of Maharashtra & Goa

- Serving International Fellow- The American College of Trust and Estate Counsel

- Past Committee Officer - Private Client, IBA

- Past Steering Committee – International Wealth Advisors Forum

- Serving Officer – International Fiscal Association, India

Recognition and Accomplishments

- The Legal 500, 2010-2018 (Asia Pacific), Legal Era has ranked her as being a leader in the field of taxation in India for many years

- Chambers & Partners (Asia-Pacific) Client Guide has recognised her as being a leading tax lawyer and private client advisor in India for many years

- Indian Lawyer 250 Law Business Research also recognises her as highly regarded name

- Recognised by Asian Legal Business in their 2021 ranking as Asia’s Top 15 Female Lawyers

- She has featured on IBLJs future legal leaders list for India, 2021

- Bijal has been awarded a number of accolades for academic excellence in law and commerce

Representative Matters

Bijal Ajinkya has represented and advised the following clients

India-Mauritius Tax Treaty

Spearheaded the team on the landmark case of “Azaadi Bachao Andolan” on the validity of India-Mauritius Tax Treaty.

United Healthcare, CSFB Securities, Nicholas Appellate, etc.

Advised on their respective domestic tax litigations at the Commissioner and Tribunal level.

Fidelity, Morgan Stanley, Dun and Bradstreet, General Electric Pension Trust, Schellenburg Witmer and other foreign clients

Advised on their advance ruling matters

Confidential

Engaged as a tax expert for a SIAC matter with respect to withholding tax obligations arising out of a services contract.

Number of clients

Advised on their entry strategy into India.

Number of clients

Advised on taxability of the IP and software services.

Various clients

Advised on tax issues arising on re-organisation of business, including, conversion of US business trusts into LLCs, merger of trusts into an LLC, etc

Several family offices, celebrities, fund professionals, ultra HNIs, Private client groups of banks / institutions like Barclays, Credit Suisse, UBS, JP Morgan, etc.

Advised on their succession and asset protection matters.

Various Offshore Funds

Advised on their structuring and documentation for investments outside of India, more specifically in Sri Lanka and Africa.

Publications

Article

Ergo Update

Article

Article

Article

Article

News and Events

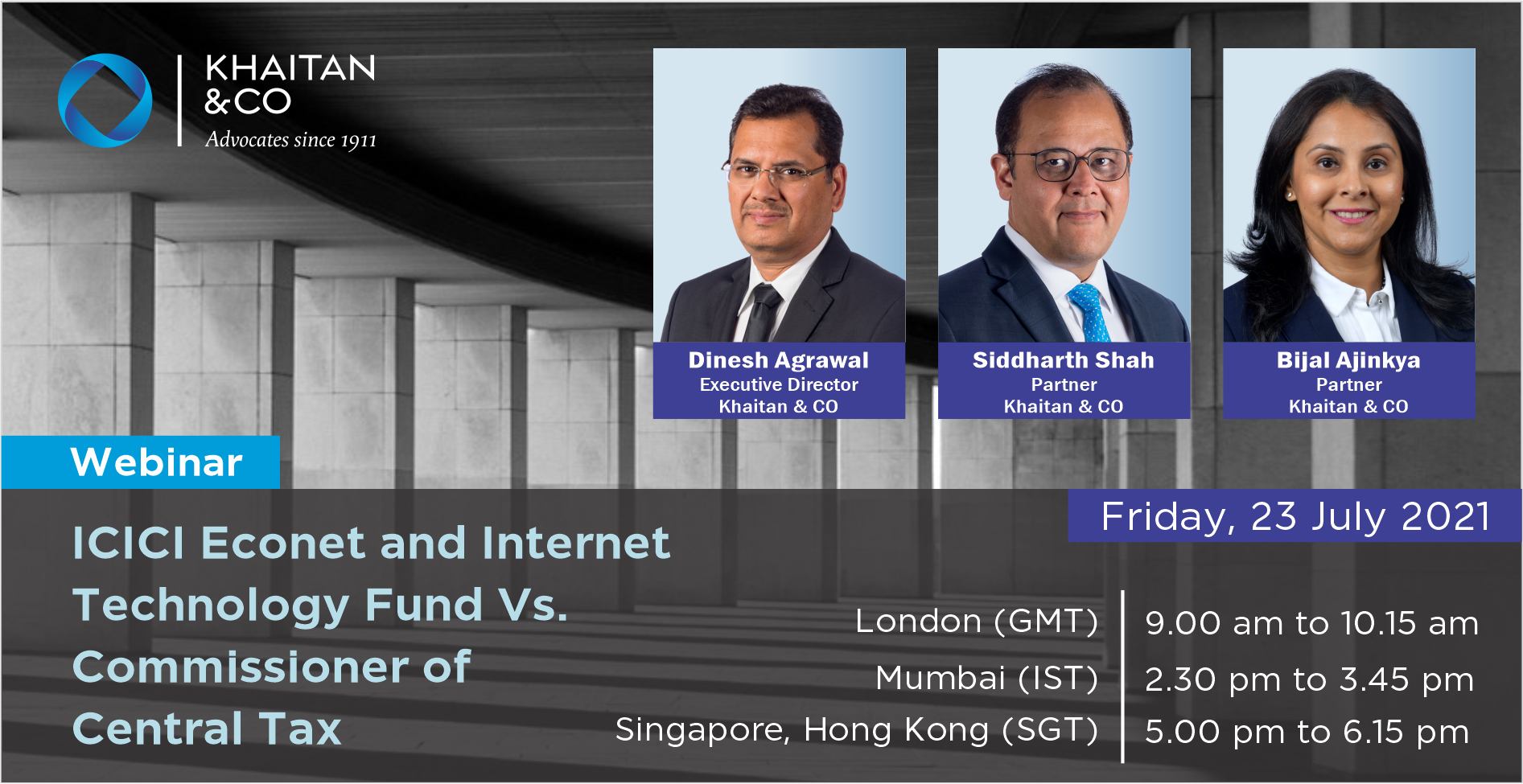

Bijal Ajinkya has featured in the following news and webinars